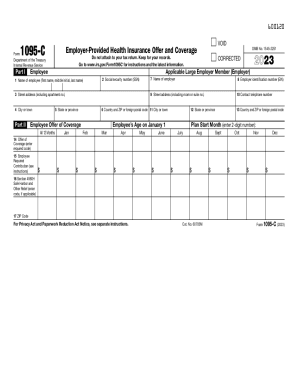

IRS 1095-C 2024-2025 free printable template

Show details

6001201095CForm

Department of the Treasury

Internal Revenue Serviceman Do not attach to your tax return. Keep for your records.

Go to www.irs.gov/Form1095C for instructions and the latest information.

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 1095-C

Clear Steps for Modifying IRS Form 1095-C

Detailed Instructions for Completing IRS Form 1095-C

Understanding and Utilizing IRS Form 1095-C

The IRS Form 1095-C, Health Coverage Offer and Coverage, is crucial for employers to report to the Internal Revenue Service (IRS) about the health insurance offered to their employees. This form is not only essential for compliance but also serves employees in assessing their health coverage during tax filing. Below is a detailed guide to help you navigate through the complexities of Form 1095-C.

Clear Steps for Modifying IRS Form 1095-C

To edit your IRS Form 1095-C effectively, follow these clear steps:

01

Review the current form for accuracy in reporting health coverage information.

02

Make necessary changes based on updated employee enrollment details or healthcare coverage offered.

03

Ensure all required fields are completed, including employee information and coverage months.

04

Use IRS instructions for guidance on specific line items that may require changes.

05

Save the edited form in a secure format for compliance and future reference.

Detailed Instructions for Completing IRS Form 1095-C

Completing IRS Form 1095-C involves a series of well-defined steps:

01

Enter the employer’s name, address, and Employer Identification Number (EIN).

02

Provide the employee's information, including name, address, and Social Security Number (SSN).

03

Document the health coverage offered in Part II, detailing the coverage months.

04

Complete Part III if applicable, providing information about any covered individuals.

05

Review the form thoroughly for accuracy before final submission.

Show more

Show less

Recent Developments and Modifications Regarding IRS Form 1095-C

Recent Developments and Modifications Regarding IRS Form 1095-C

Stay up to date with the important changes that may affect your completion and submission of IRS Form 1095-C:

01

Adjustments to the affordability threshold have changed from 9.83% to 9.61% for the year, impacting the definition of affordable coverage.

02

Updates in tracking health exemptions now require more detailed record-keeping for specific transactions and demographics.

03

Employers are encouraged to provide additional documentation to ensure compliance and ease audit risks.

Essential Insights on IRS Form 1095-C: Purpose and Use

What is IRS Form 1095-C?

Purpose of the IRS Form 1095-C

Who Needs to Complete This Form?

Conditions Under Which Exemptions Apply

Components of IRS Form 1095-C

Filing Deadlines for IRS Form 1095-C

Comparing IRS Form 1095-C with Similar Forms

Health Care Transactions Covered by Form 1095-C

Required Number of Copies for Submission

Penalties for Failing to Submit IRS Form 1095-C

Key Information Required for Filing IRS Form 1095-C

Additional Forms That Accompany IRS Form 1095-C

Where to Submit IRS Form 1095-C

Essential Insights on IRS Form 1095-C: Purpose and Use

What is IRS Form 1095-C?

IRS Form 1095-C is a tax form that provides information regarding health coverage offered to employees by applicable large employers (ALEs). The form includes details on whether the coverage meets the minimum essential coverage standards set by the Affordable Care Act (ACA).

Purpose of the IRS Form 1095-C

The primary purpose of Form 1095-C is to inform both the IRS and employees about the type of health insurance coverage provided. This form assists in verifying compliance with the ACA's employer mandate and helps determine eligibility for premium tax credits for individuals.

Who Needs to Complete This Form?

Applicable large employers, defined as those with 50 or more full-time equivalent employees, are required to complete Form 1095-C. This includes both private-sector employers and government entities offering health coverage to employees.

Conditions Under Which Exemptions Apply

Certain conditions qualify employers for exemptions from completing Form 1095-C:

01

Employers with fewer than 50 full-time equivalent employees are not required to file.

02

Employers offering coverage for only part of the year may qualify for exemption under specific regulations.

03

Employers operating in certain industries, such as non-profits, may have special considerations.

Components of IRS Form 1095-C

The form consists of several key components:

01

Part I includes information about the employer and employee.

02

Part II details the health coverage offered, focusing on the months covered and the affordability.

03

Part III, if applicable, provides information on covered individuals under the employee’s health plan.

Filing Deadlines for IRS Form 1095-C

The deadline for submitting Form 1095-C to the IRS is typically the last day of February for paper filings, and March 31 for electronic submissions. Additionally, employers must ensure distribution of the 1095-C forms to employees by January 31.

Comparing IRS Form 1095-C with Similar Forms

IRS Forms 1095-A and 1095-B serve different purposes compared to Form 1095-C:

01

Form 1095-A is typically for individuals who purchase health coverage through the Health Insurance Marketplace, detailing the coverage obtained.

02

Form 1095-B reports minimum essential coverage provided by small employers or other qualifying entities that do not meet the large employer requirements.

Health Care Transactions Covered by Form 1095-C

The transactions generally covered by Form 1095-C are any offered health plans that meet minimum essential coverage requirements, including:

01

Employer-sponsored group health plans

02

Self-insured health plans

Required Number of Copies for Submission

Employers need to submit one copy of Form 1095-C to the IRS for each employee who was provided health coverage during the reporting year, along with the 1094-C transmittal form that summarizes all 1095-Cs.

Penalties for Failing to Submit IRS Form 1095-C

The IRS imposes penalties for failing to file or distribute Form 1095-C timely:

01

Employers can incur up to $280 per 1095-C for late or incorrect filings.

02

Severe noncompliance, defined as failure to file without reasonable cause, can lead to even larger fines up to $3,392,000 annually for large organizations.

Key Information Required for Filing IRS Form 1095-C

To ensure proper filing of Form 1095-C, employers must gather the following information:

01

Employer's EIN and contact information.

02

Details on the health plan or plans offered, including dates and costs.

03

Employee details, such as SSN, address, and full-time status.

Additional Forms That Accompany IRS Form 1095-C

Often, Form 1095-C is accompanied by Form 1094-C, which is the transmittal form summarizing the total number of 1095-Cs being submitted.

Where to Submit IRS Form 1095-C

Form 1095-C should be submitted to the IRS either electronically or via mail, depending on the method decided by the employer. The mailing address varies based on whether you are including a payment; a complete list is available on the IRS website.

By following this comprehensive guide, employers can simplify the process of completing and submitting IRS Form 1095-C while ensuring compliance with regulations. Should you have any further questions or require assistance in using tools like pdfFiller for document management, do not hesitate to reach out for support.

Show more

Show less

See what our users say

Read user feedback and try pdfFiller to explore all its benefits for yourself

I am not able to give my newly created file a name in

"save as" mode. Help!

Great program! Easy to use! It is just a little too expensive.

Try Risk Free